What is the mobile DTH recharge business all about?

With the user base for Telecom and DTH subscribers growing leaps and bounds, a number of third-party recharge players like FreewayRecharge are trying to tap into this fastest growing market.

Imagine you reach home after a long day at work. Suddenly you realize that you have to make an urgent call or your DTH needs to be recharged as you have run out of cash balance.

What do you do? Do you want to make the effort of going all the way to a recharge shop to top-up your account. Well, there is a simple solution to this problems: simply log on to www.freewayrecharge.com website and recharge your mobile or DTH account within minutes. And that too at the convenience of your home! Paid through a safe and secure payment gateway provided by E-Billing Solutions were you could pay through your Debit/Credit Card or Net Banking. Could this be a potential business opportunity for many? And what if do not have excess to internet facility. In this article, we shall discusses on the nitty-gritty of entering doing such a business.

How big is the Telecom and DTH Recharge market?

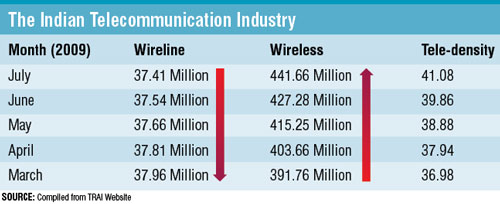

The telecom industry in India is growing at breakneck speed, and the majority of the growth is contributed by the wireless or mobile segment. In July 2009, TRAI estimated India’s tele-density to be 41.08 with the total telephone subscriber base reported to be 479.04 million. Of this, while the wire line base was just 37.41 million, wireless subscription (including GSM, CDMA and FWP) accounted for 441.66 million connections. What is even more interesting is that a majority of the wireless connections, almost 90% of them are prepaid. Given an ARPU of around Rs 200, we can assume that an average recharge is Rs 200 per month, or Rs 2400 per year. Based on these numbers, the recharge industry size works out to be approximately Rs 9600 crore per year.

Talking of DTH, though the number of players in this sector are few, they are also reportedly expanding at 35-40%. India’s TV viewership is believed to be the second highest in the world and is expected to swell up to 35-40 million by 2012. The installed base of DTH is very small compared to this number. So, this space also remains mostly untapped and could offer a big opportunity to recharge players.

| The Industry Landscape | |

| Mobile connections in India | 441.66 million |

| Prepaid connections (90%) | 397.49 million |

| Average recharge per month per person | Rs. 200 |

| Average recharge annually per person | Rs. 2400 |

| Total Recharge Industry | Rs. 9600 crore |

Business models (Online and Offline)

The recharge market in India is vast and is on the lookout for new channels to expand. Currently, the market can be broadly split into two – offline and online.

Offline Recharge Market:

The offline sector is dominated by scratch cards that are distributed by telecom players and sold through retail outlets ranging from Mobile sales and repair shops to the more generic pan shops.

Currently, the market is dominated by recharge cards than by e-recharges. The scratch card segment works through a PIN recharge model, wherein a telecom service provider sells a 16 digit PIN to the user through the scratch cards. For this, a number of background processes take place at the service provider’s end including the generation and scrambling of the 16 digit PIN, printing it and then the customer (or more usually the retailer) SMSes the code to the service provider to recharge the customers account.

Typically, each service provider has multiple recharge plans (usually 5 or more) running at any time and each telcom circle has about 5 players. So, a retailer has to stock 25-30 different varieties of scratch cards. In practice, the retailer stocks only the more popular plans and sometimes is even selective about the service provider. So, a given retailer may actually stock under 10 different recharge options.

The margins in the recharge business is wafer thin. There is no concept of wholesaler in this business. For most retailers, recharge cards are top-up income or at best help draw customers who may also buy something else from him. More money is to be made from activation (selling a new prepaid SIM card to a customer and activating his number) than from selling a recharge coupon. The online recharge model does away with the retailer but every one in India specially the rural India does not have excess to debit/Credit cards or internet banking but Mobile phones and DTH have entered these area creating a vast business opportunity and that is were the role of Single SIM recharge through SMS plays a very big role.

Online Recharge Market:

On the other hand, the online recharge business is serviced by several channels – the service providers through their own websites and recharge through ATMs have been the traditional methods here. Third party recharge players such as freewayrecharge.com, are the new entrants in the fray. Who provide a safe and secure payment gateway of E-Billing Solutions were a customer could pay through his Debit/Credit Card or Net Banking.

Since the user interface of these players is a website, the target audience is mostly urban population. Defining the target audience base further, only those with easy internet access as well as those who feel comfortable purchasing online are currently customers to this service. According to a study conducted by the Internet and Mobile Association of India (IAMAI) and IMRB International, India had an estimated 45.3 million ‘active’ Internet users as on September 2008, of whom 42 million were from the urban areas. This could as well be the potential customer base for an online third party recharge player. There are some moves by the online players to dramatically increase their target base. More about that later.

How is freewayrecharge different from other recharge companies and does Single SIM Recharge also known as Single SIM Multi Recharge model work?

Freewayrecharge provides its customers to recharge their Pre Paid Mobile Phones. Data Card and DTH through safe and secure payment gateway of EBS as well as by subscribing for its Single SIM Recharge were we provide online as well as offline recharge options to customers. There are several reasons behind this. From the point of view of consumers, this option offers convenience. We ease this process by providing all the recharge options of all telecom players on a single platform online as well as offline by activating your SIM Card as a Multi Recharge Machine. The customer need not spend any amount by changing his mobile phone or SIM card. Every consumer who is registered can deposit fund in our company account and receive fund in his wallet that can be accessed online as well as offline via SMS and at the convenience of their homes. This also gives customer the right to chose how he would like to recharge his mobile, data card or DTH throughout India by using the payment gateway facility or wallet facility provided by freewayrecharge.

Moreover, the expertise of the telecom service provider is to provide service rather than selling recharge coupons. And this kind of feature is even difficult to find on most service providers’ websites”.

What is the revenue model?

So how do these players make money? These players either deal with the telecom players directly or through aggregators. Similar is the case with DTH services. Whenever a customer comes to the site for a recharge, the telecom service provider pays up to an average of 4% of the recharge amount to the third party vendors.

| DTH Players |

| Tata Sky |

| Sun Direct TV |

| Airtel Digital TV |

| Dish TV |

| Reliance Big TV |

The recharge vendor has to pay about 3% to the payment gateway provider. That typically leaves the recharge player with a 1 % margin, from which all their costs including technology costs have to be met. And that makes this a volume game. Of course, these percentages are negotiable, given volumes and relationships with payment gateways and service providers.

Some players have incorporated other revenue channels for increasing their margins. One way is to charge a transaction or convenience fee like IRCTC does. For example, Fastrecharge.com and Onestoprecharge.com charges an Internet service charge of 11% and 4% respectively to its customers. Another revenue source (albeit a minor one) could be Internet advertising.

Some challenges

There are several challenges that this segment of the industry faces. One, establishing a relation with the telecom players is a hard nut to crack. This is because these players already have a fairly good distribution network for scratch cards. Two, since this sector is dependent on technology, it needs constant upgradation. Security of online transactions is another critical factor. Managing dealings with payment gateways require constant monitoring and reconciliation. Automated systems that can do this become the norm for large volumes. You also need an efficient redressal system to deal with customers who pays for a recharge but whose recharge does not happen. Freewayrecharge.com for example says that they try to keep this down by doing an automatic credit back if a recharge is not successful at the service provider end – that is, if their systems do not get an acknowledgment from the service providers’ systems of a successful recharge.

Like we briefly discussed earlier, another way could be to increase the target audience by introducing new channels or aggressively adopting existing channels to your business. One of the limitations for the online recharge business has been the limiting of their target audience to the urban population with easy Internet access. On the other hand, large volumes of recharge users become part of your target if you include rural and those with no internet access. The route to this of course is the huge mass of retailers who deal with paper based recharge coupons.

One way of doing it is similar to what IRCTC has done – enable existing resellers (agents in the case of IRCTC) to use your platform and add that to your business. For e-recharge, the online recharge player has to first create an e-wallet for the retailer who then recharges against the balance available in his wallet. An e-wallet is a virtual wallet, i.e. a retailer has to credit his e-wallet account in advance and recharges done gets debited against that, much like a debit card.

Conclusion

It is early days still for the business of online recharge. The number of players is still small. The potential market size is huge, but the margins are wafer thin. The winners will be not just the ones who achieve scale and efficiencies of operation which are given, but the ones who are able to break through the clutter and add new income sources or payment options like micro payments to their existing platforms.